Medicare Plans

The different parts of Medicare can be a little confusing, so we’ve broken it down as simply as possible. After reading through our overview, feel free to explore our site for more in-depth information. If you have specific questions and want immediate answers, call us to have one of our insurance specialists provide clear

What are your Medicare Benefit Options?

Once eligible to receive Medicare, you can choose how to obtain your coverage through either:

- Original Medicare (Parts A & B), with the option of joining a Prescription Drug plan and/or a Medigap policy as well, or

- Medicare Advantage plan (Part C), with the option of adding a stand-alone Prescription Drug plan.

As a future beneficiary, you should choose the coverage plan that best meets your medical needs and budget, and review your plan each year to reevaluate and adjust as needed.

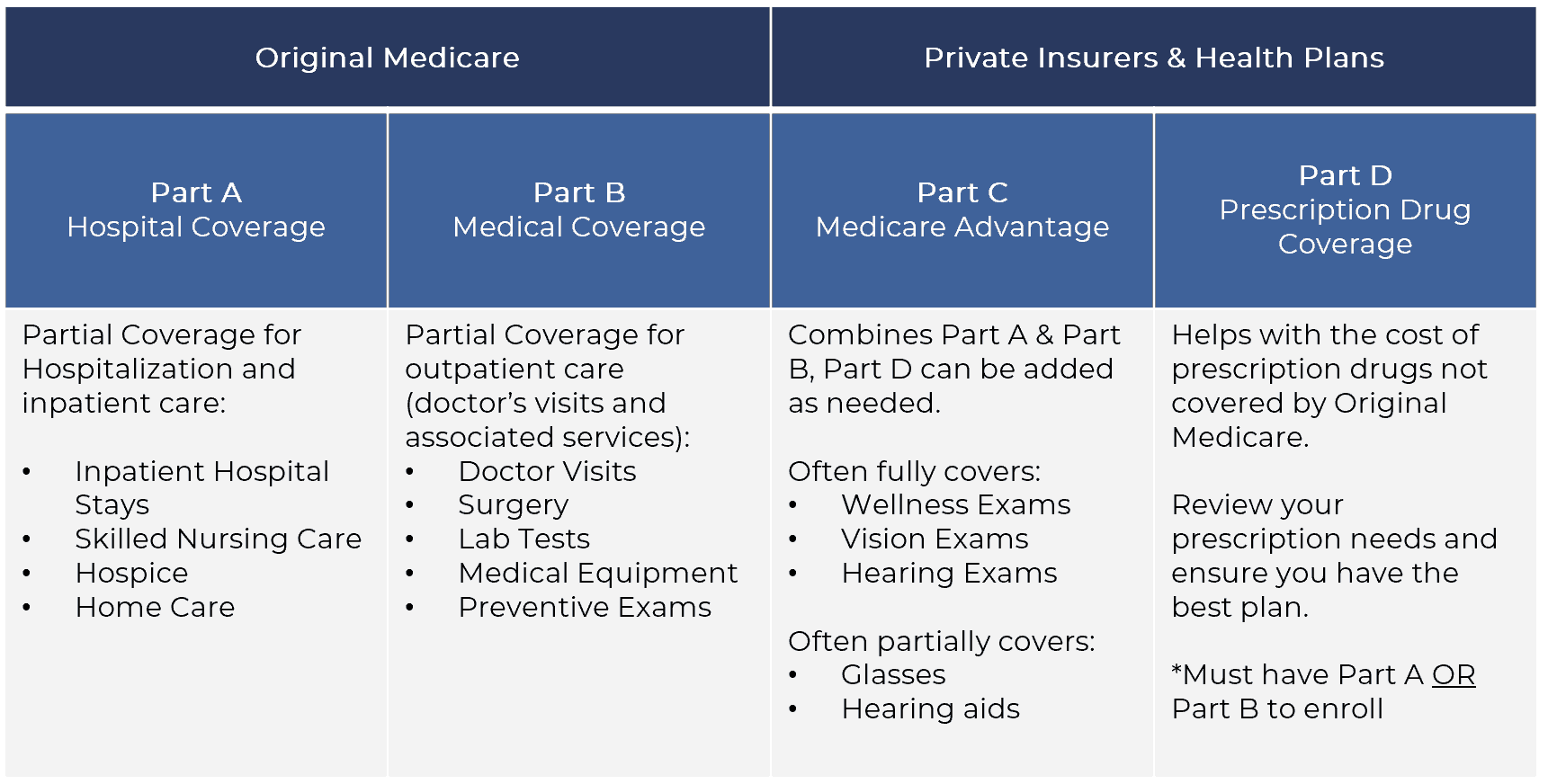

Let’s explore the Medicare coverage options available and what is or isn’t covered under each plan.

- Part A

- Part B

- Part C (Medicare Advantage)

- Part D

- Medigap

- Plan Comparison

Part A Coverage

Medicare Part A is the first part of Original Medicare, which is a federal government program that offers health insurance to our seniors.

What Does Part A Cover?

Part A provides benefits for inpatient hospital care, skilled nursing facility care, inpatient skilled nursing facility care, hospice care and home health care.

What Does Part A Not Cover?

Part A coverage will pay for a large amount of your health expenses, but not all of it.

The following will be out-of-pocket costs that you are responsible for, unless you purchase a Medigap policy to offset these expenses:

Part A Does Not Cover

• Long-term nursing care (over 100 days)

• Physical exams other than your annual wellness visit

• Routine foot care

• Acupuncture, naturopathy

• Cosmetic surgery

• Hearing aids

• Dentures and denture care

• Medicare care outside of the United States

Learn more about Medicare Part A coverage, eligibility, costs and enrollment on our Medicare Part A page.

What is Medicare Part B and what does it cover?

Part B is the second part of Original Medicare that provides benefits for doctor services and other health care providers, outpatient care, and durable medical equipment, such as wheelchairs, walkers and hospital beds. It also covers many preventative services, such as mammograms and flu shots.

Part B also covers some medical services not covered under Part A, such as certain types of occupational therapy, physical therapy, mental healthcare and home healthcare services. Additionally, coverage under Part B includes ambulance services, cancer treatments, and diagnostic imaging.

What Does Part B Not Cover?

Part B coverage will pay for a large amount of your health expenses, but not all of it. The following will be out-of-pocket costs that you are responsible for, unless you purchase a Medigap policy to offset these expenses:

Part B Does Not Cover:

• Physical exams other than your annual wellness visit

• Routine foot care

• Acupuncture, naturopathy

• Cosmetic surgery

• Hearing aids

• Dentures and denture care

• Medicare care outside of the United States

Learn more about Medicare Part B coverage, eligibility, costs and enrollment on our Medicare Part B page.

What is Medicare Advantage?

Medicare Advantage, which is not a part of Original Medicare, is an alternative option for those who want more coverage than what Part A and Part B offers.

Medicare Advantage plans are operated by private insurance companies that not only provide benefits that meet or exceed those found in Original Medicare, but also covers those additional out-of-pocket costs that you are charged. It is a plan that bundles together Part A, Part B and usually Part D.

What does Medicare Advantage Cover?

Medicare Advantage provides the same benefits found in Original Medicare, with the exception of Hospice, which is still covered under Part A.

Medicare Advantage also offers benefits for dental, vision and hearing, as well as gym memberships, transportation and a 24-hour nurse line.

With lower premiums than Medigap, Medicare Advantage can provide a great value to those who want more benefits for their insurance dollars.

Learn more about Medicare Advantage, why it was created, coverage, pros and cons, costs and enrollment on our Part C – Medicare Advantage page.

Part D Coverage

Medicare Part D is the prescription drug coverage administered by Medicare. It gives beneficiaries the opportunity to purchase retail prescriptions at an affordable, discounted rate, as opposed to paying the full price out-of-pocket, and being at risk of prescription price increases.

Medicare prescription drug coverage can be provided by a stand-alone Medicare Part D plan (only prescription coverage), or a Medicare Advantage plan that includes prescription coverage. To enroll in Part D, you do not go through Medicare, but to a private insurance company in your state that is approved by Medicare.

Learn more about Medicare Part D, costs, securing coverage, late enrollment penalties and other important terms and information on our Medicare Part D page under Coverage Options.

What is a Medigap Plan?

A Medicare Supplement plan, also known as Medigap, is health insurance that is offered by private insurance companies to fill the gaps that Original Medicare doesn’t cover. Medigap supplement policies lower out-of-pocket costs for deductibles, copayments and services not covered by Medicare Parts A and B.

What Medigap Typically Covers:

• Medicare Part A and B deductibles

• Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

• Medicare Part B coinsurance or copayment*

• Blood (first 3 pints)

• Part A hospice care coinsurance or copayment*

• Skilled nursing facility care coinsurance

• Part B excess charges

• Coverage for emergency services while traveling overseas, which aren’t covered under Medicare

*Coverage may be partial for some plans. Medigap Plan N covers the Part B coinsurance, except for up to $20 copayment for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

What Medigap Doesn’t Cover:

• Retail prescription drugs

• Routine vision, dental and hearing exams

• Eyeglasses or contacts

• Hearing aids

• Long-term care

• Custodial care

Learn more about Medigap Supplemental plans, how Medigap policies work, coverage and enrollment on our Medigap page under Coverage Options.

Want To Learn More About Medicare?

We encourage you to watch our educational videos, read our monthly blog posts, or join us for any of our virtual, interactive webinars where you can quickly learn the fundamentals of Medicare from the comfort of your home.